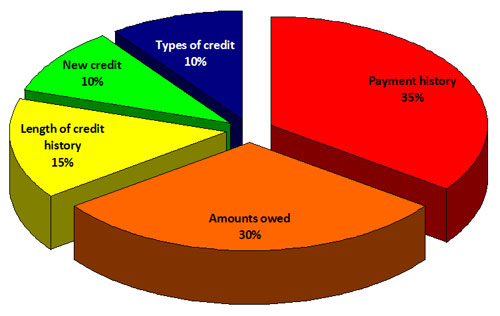

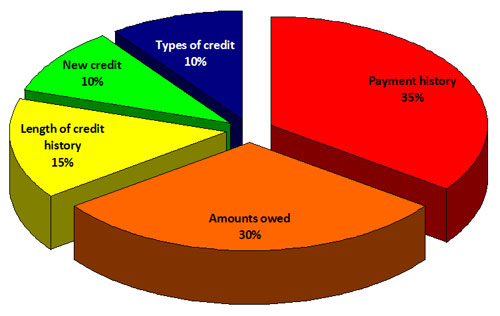

Most people go into getting a loan without really knowing the details about how they work and what exactly they're doing to your credit. The basis of it is simple: Its money given given to you in a lump sum to make a purchase. You pay back the money over a set period of time at a rate of interest. To really understand the concept, you first have to realize and understa nd that ALL money is technically a loan. All the money that exists (especially in banks) is "owed" to someone else, so first get over the fact that the "money" is yours. Now, when you apply for a loan they look at your credit history and credit score. Your score is based on a point system that measures your amount of debt, what kind of debt you have, and your propensity to pay (or risk). All of these factors are configured to determine a 3 digit number ranging from 350-900 points (the range voluntarily changes and can change at ANY time). All banks and private lenders look at the history and score to determine how much of a risk you are. From there they set your interest rate and loan term. These vary depending on which institution you go to.

nd that ALL money is technically a loan. All the money that exists (especially in banks) is "owed" to someone else, so first get over the fact that the "money" is yours. Now, when you apply for a loan they look at your credit history and credit score. Your score is based on a point system that measures your amount of debt, what kind of debt you have, and your propensity to pay (or risk). All of these factors are configured to determine a 3 digit number ranging from 350-900 points (the range voluntarily changes and can change at ANY time). All banks and private lenders look at the history and score to determine how much of a risk you are. From there they set your interest rate and loan term. These vary depending on which institution you go to.

Things like student loans and minimal credit card debt to affect you, but not as much as your propensity to pay vs. how big of a loan you have. For example: paying perfectly on a credit card with a limit of $500 will only take your score but so far. But paying perfectly on a mortgage, or car loan worth thousands of dollars can create a good score. Why? Because of the risk. Credit is measured by how much revolving debt you have. Crazy right? You spend so much time trying to get out of debt, but in order to get out of it or have a good score, you have to have be in debt. Get rid of it and you'll have a hard time getting things like loans, credit cards, jobs, etc...

nd that ALL money is technically a loan. All the money that exists (especially in banks) is "owed" to someone else, so first get over the fact that the "money" is yours. Now, when you apply for a loan they look at your credit history and credit score. Your score is based on a point system that measures your amount of debt, what kind of debt you have, and your propensity to pay (or risk). All of these factors are configured to determine a 3 digit number ranging from 350-900 points (the range voluntarily changes and can change at ANY time). All banks and private lenders look at the history and score to determine how much of a risk you are. From there they set your interest rate and loan term. These vary depending on which institution you go to.

nd that ALL money is technically a loan. All the money that exists (especially in banks) is "owed" to someone else, so first get over the fact that the "money" is yours. Now, when you apply for a loan they look at your credit history and credit score. Your score is based on a point system that measures your amount of debt, what kind of debt you have, and your propensity to pay (or risk). All of these factors are configured to determine a 3 digit number ranging from 350-900 points (the range voluntarily changes and can change at ANY time). All banks and private lenders look at the history and score to determine how much of a risk you are. From there they set your interest rate and loan term. These vary depending on which institution you go to.Things like student loans and minimal credit card debt to affect you, but not as much as your propensity to pay vs. how big of a loan you have. For example: paying perfectly on a credit card with a limit of $500 will only take your score but so far. But paying perfectly on a mortgage, or car loan worth thousands of dollars can create a good score. Why? Because of the risk. Credit is measured by how much revolving debt you have. Crazy right? You spend so much time trying to get out of debt, but in order to get out of it or have a good score, you have to have be in debt. Get rid of it and you'll have a hard time getting things like loans, credit cards, jobs, etc...

These companies can help to erase somethings from you credit and get you on the right path to rebuilding a solid credit foundation. Can they boost your score? Sometimes yes. Just because something is no longer on your credit can actually hurt you, why? You've eliminated some of the revolving debt. Approach them with caution, but overall they can be a good thing.

But the best way to help repair and build your credit is simple: Pay on time. Get credit card with a lower limit and lower interest rates. Only take out loans of you have to, and UNDERSTAND that whoever is lending you the money is taking just as much of a risk (sometimes a bigger risk) than you are. So if you're hit with a high interest rate, or a lower loan...ask yourself about your history.

No comments:

Post a Comment